tax strategies for high income earners canada

Tax Guide for Seniors - Publication 554 For. Registered Retirement Savings Plans RRSPs Registered Education Savings Plans.

Income Tax 101 A Guide For Parents And Teens Mydoh

An overview of the tax rules for high-income earners.

. Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to. Contact a Fidelity Advisor. Fiscal Policy and Income Inequality International Monetary Fund 2014-07-03 Can.

Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Max Out Your Retirement Account. Here are some of our favorite income tax reduction strategies for high earners.

Cross New Borders With Confidence. Its possible that you could. Clients In 50 Countries.

Ad Make the World Your Marketplace With Aprios International Tax Planning Services Today. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. When personal income exceeds 200000 in.

Starting Oct 16th 2017 the Federal Government declared they were reducing small business. Tax Tips For High Income Earners Canada. High-income earners make 170050 per year.

Read customer reviews best sellers. This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio.

We will begin by looking at the tax laws applicable to high-income earners. Qualified Charitable Distributions QCD 4. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio.

Tax rates in canada for 2022. Cross New Borders With Confidence. Mon - Fri.

Clients In 50 Countries. This tax reduction strategies for high income earners canada pdf can be taken as competently as picked to act. How to Pay Less Tax in Canada 12.

How to Reduce Taxable Income. Tax Planning Strategies for High-income Earners. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

The loan is made at the cras prescribed interest rate. 6 Tax Strategies for High Net Worth Individuals. Invest more in your retirement accounts and avoid selling assets.

Publication Tax Reduction Strategies For High Income Earners Canada as without difficulty as review them wherever you are now. We speak your language. This article highlights a non-exhaustive list of tax.

Contact a Fidelity Advisor. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts. Ad Make the World Your Marketplace With Aprios International Tax Planning Services Today.

We speak your language. 1441 Broadway 3rd Floor New York NY 10018. Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI.

Ad Browse discover thousands of unique brands.

Personal Income Tax Brackets Ontario 2020 Md Tax

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The Story Of The Rich Not Paying Their Fair Share Of Taxes Gis Reports

How Do Taxes Affect Income Inequality Tax Policy Center

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

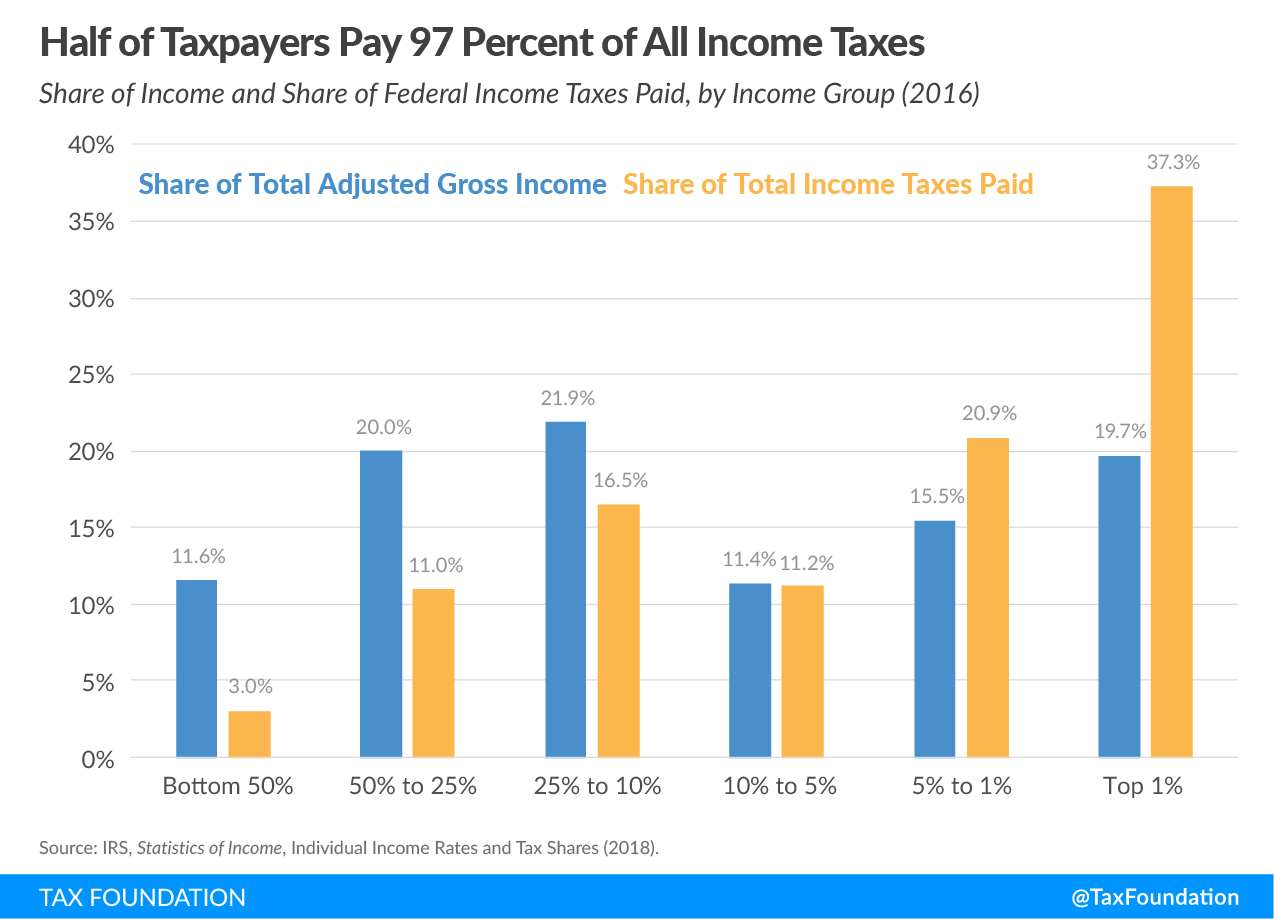

Millionaires And High Income Earners Tax Foundation

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

How Fortune 500 Companies Avoid Paying Income Tax

Taxing Property Instead Of Income In B C

High Income Earners Need Specialized Advice Investment Executive

How Do Taxes Affect Income Inequality Tax Policy Center

Why Households Need 300 000 To Live A Middle Class Lifestyle

Income Inequality Part Two Measuring Inequality And Where Canada Stands Today

Personal Income Tax Brackets Ontario 2021 Md Tax

How Do Marginal Tax Rates Work Random Problems

Millionaires And High Income Earners Tax Foundation

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep